The Stewardship Blueprint: From Hammurabi's Code to Modern Dominion

- Reuben Lowing

- 24 hours ago

- 6 min read

Let's get something straight from the jump: There's a massive difference between being a steward of your money and being a slave to it.

Most people wake up every day answering to their debt. Their car payment dictates their career choices. Their credit cards determine whether they can say "yes" to their kid's field trip. Their 401(k) tells them when: and if: they can retire. That's not stewardship. That's servitude.

Here's the gut-punch truth: financial mismanagement isn't just about bad math or poor planning. In the ancient sense, it's literally "missing the mark": what the original Greek word for sin actually meant. Not because money is evil, but because when you're financially underwater, you can't fulfill your purpose. You can't serve. You can't build. You can't protect your family or invest in the Kingdom work you were called to do.

The guy working 70 hours a week just to stay broke? He's not lazy. He's trapped. And somewhere in our history, we lost the blueprint for breaking free.

That blueprint is older than you think.

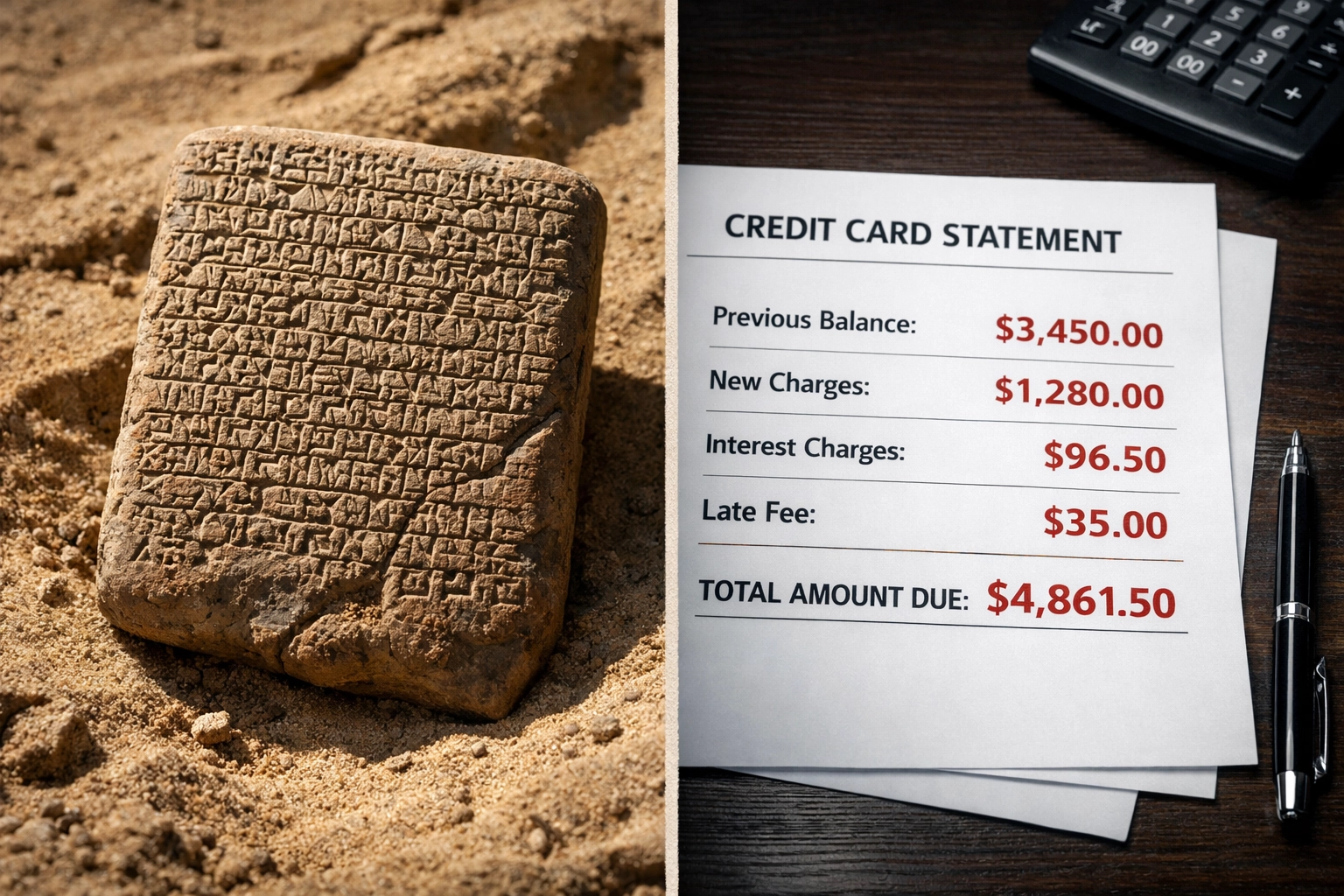

The Ancient Code: The Foundation Most People Misunderstand

Around 1750 BC, a Babylonian king named Hammurabi chiseled out 282 laws on a massive stone slab. It wasn’t a suggestion: it was the law. And a big chunk of it revolved around money, property, and consequences.

Here’s what I don’t want you to hear me saying: Hammurabi’s Code wasn’t “evil.” It was an early framework for order, accountability, restitution, and commerce: the kind of structure any growing society needs to function.

And there’s another layer a lot of people miss: when you look at the Law of Moses (the 613 instructions) there are clear connections in wording and structure that mirror earlier legal language: often the same kind of “if/then” case law. One notable difference you’ll see in many places is how restitution is handled: where an older system might lean toward fines and payments (shekels), the Mosaic system frequently ties restoration to sacrifice, purity, and access to God. The principles of order and responsibility stay consistent, even when the spiritual system shifts.

That matters, because it means this isn’t a “Hammurabi vs. Moses” cage match. It’s a thread of ancient wisdom about stewardship: consequences are real, responsibility is required, and prosperity needs structure.

But here’s where the story shifts.

The Blessing Over the Curse: Melchizedek and the First Tithe

Fast forward a few centuries to Genesis 14. Abraham: still called Abram at this point: has just won a battle. He's got the spoils, the glory, the momentum. And then this mysterious priest-king named Melchizedek shows up with bread and wine.

No threats. No fines. No eye-for-an-eye justice.

Instead, Melchizedek blesses Abraham. And Abraham: unprompted: gives him a tenth of everything.

This is the origin of the tithe, but it's deeper than a religious tax. It's the first recorded act of financial stewardship rooted in blessing, not fear. Abraham wasn't paying a fine or avoiding punishment. He was acknowledging that everything he had came from a higher source, and he was managing it accordingly.

This is the shift: from transactional obligation to relational stewardship.

Melchizedek represented a different system: one where resources flow through you, not to you. Where you're a manager, not an owner. Where generosity and blessing multiply instead of scarcity and punishment crushing you.

That's the model we're trying to get back to.

Wilderness Discipline: The Midianite Wisdom Moses Almost Missed

Moses spent 40 years in the wilderness before God called him to lead Israel out of Egypt. But what most people miss is who taught him how to survive out there: his father-in-law, Jethro: a Midianite priest.

The Midianites were desert people. They understood structure, organization, and resource management in harsh conditions. When Moses was drowning in the administrative chaos of leading millions of people, it was Jethro who gave him the blueprint: delegate, organize, establish systems.

Exodus 18:13-26 is basically the world's first leadership manual. Jethro told Moses, "You're going to burn out. You need structure. You need a system." And Moses listened.

But here's the kicker: while Moses was up on the mountain receiving the Ten Commandments: the ultimate structure for life: the people below melted down their gold and built a calf. They traded stewardship for a shortcut. They wanted security they could see and control.

The Golden Calf wasn't just idolatry. It was the ultimate financial mistake. They took their wealth and turned it into something that couldn't produce, couldn't protect, and couldn't provide.

It was the ancient version of blowing your tax refund on a jet ski.

The wilderness wasn't punishment. It was preparation. Forty years of learning discipline, structure, and dependence on provision beyond their control. God was teaching them stewardship the hard way.

Jesus, Paul, and the Wilderness Advantage

When Jesus started His ministry, where did He go first? The wilderness. Forty days of fasting, testing, and preparation.

Paul? After his Damascus Road conversion, he spent three years in the Arabian wilderness before he started preaching.

The pattern is clear: the wilderness is where you learn dominion. Not the flashy stage. Not the boardroom. The wilderness.

It's in the hard seasons: the lean years, the grind, the struggle: that you develop the discipline required to steward blessing. Jesus faced every temptation in that desert and came out with absolute clarity on His mission. Paul wrestled with his theology and emerged with a framework that would shape Christianity for millennia.

The wilderness strips away the noise and forces you to build structure, discipline, and faith.

That's where financial dominion is forged.

The Modern Bridge: From Ancient Discipline to the Debt Freedom Flywheel

So how does all this ancient wisdom translate to your checking account, your credit cards, and your retirement plan?

Simple: You need structure. You need discipline. And you need a system that turns stewardship into momentum.

That's the Debt Freedom Flywheel.

Just like Jethro gave Moses a system to organize chaos, just like Jesus used the wilderness to prepare for ministry, you need a financial structure that protects your resources and builds dominion.

Here's the blueprint:

Step 1: Stop Living Under a Punishment System

Cut the punitive debt. The credit cards charging 24% interest aren’t helping you build anything: they operate like an old-school “pay up or pay more” system. Dollar for dollar, penalty for penalty, you’re getting hit every month you carry a balance.

Step 2: Build Your Nehemiah Wall

Nehemiah rebuilt the walls of Jerusalem to protect the city. You need financial walls: barriers that keep your money working for you, not leaking out to lenders, banks, and creditors.

This is where Indexed Universal Life (IUL) insurance strategies and Family Banking concepts come in. These aren't just insurance products: they're modern-day financial walls. They create a protected space where your money grows, compounds, and stays accessible without the penalties and restrictions of traditional retirement accounts.

It's not about chasing returns. It's about creating structure and control.

Step 3: Shift from Transaction to Stewardship

Remember Melchizedek? The blessing model? That's where you're headed. Once you've eliminated punitive debt and built your walls, you shift into stewardship mode. Your money flows through you: to fund your purpose, bless your family, invest in Kingdom work.

You're no longer reacting to emergencies or scrambling to make payments. You're proactive. You're in dominion.

Take Dominion Over Your Finances Today

Here's the reality: You weren't created to be broke, stressed, and stuck in survival mode. You were designed for dominion: to build, create, protect, and provide.

But dominion without discipline is just chaos. And discipline without structure is exhausting.

The ancient blueprint is still valid: Learn in the wilderness. Build walls of protection. Operate as a steward, not a slave.

Whether you're a barber, a welder, an HVAC tech, or a business owner, the principle is the same. Your finances aren't separate from your calling: they're the infrastructure that makes your calling possible.

Stop letting a punishment-based system run your life. Stop building Golden Calves. Step into the wilderness, learn the discipline, and build the structure that leads to true financial freedom.

Ready to take the next step?Book a financial literacy consultation and let's build your personalized Stewardship Blueprint. It's time to move from survival to dominion.

Your calling is too important to stay financially trapped.

.jpg)

Comments