🎠 Blog Post Carousel Preview

- Reuben Lowing

- Dec 18, 2025

- 5 min read

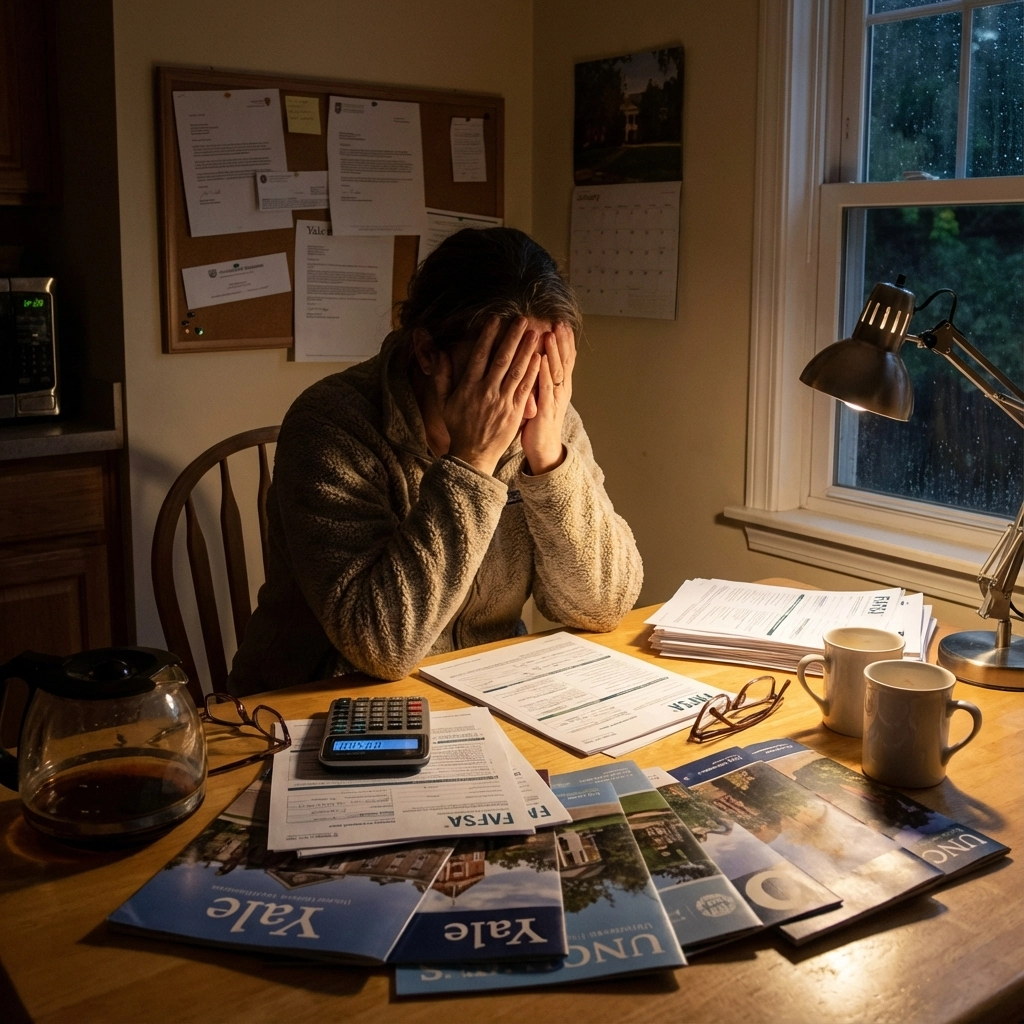

Card 1: FAFSA Secrets Revealed

💰 Hidden Life Insurance Hack Discover how whole life insurance policies can legally hide assets from FAFSA calculations while building tax-free college funds. Financial advisors rarely share this strategy because it doesn't generate ongoing fees!

Card 2: 7 Common FAFSA Mistakes

🚫 Asset Protection Red Flags Parents are unknowingly sabotaging their financial aid by making these critical errors. Learn the smart asset restructuring moves that can save thousands in college costs.

Card 3: Become Your Own Bank

🏛️ Family Banking Strategy Skip the college debt trap! Smart families use infinite banking concepts to pay for college while simultaneously building generational wealth. It's like having your cake and eating it too.

Card 4: Stop Wasting Money on 529s

⚡ IUL vs 529 Showdown 529 plans actually hurt your FAFSA eligibility! IUL insurance offers better growth potential, zero FAFSA impact, AND life insurance protection. Time to ditch the conventional wisdom.

Card 5: Military Family College Hack

🎖️ Navy SEAL Strategy This decorated veteran reveals how military families can leverage their unique benefits alongside strategic life insurance to create bulletproof college funding plans.

Stop Wasting Money on 529 Plans: Why IUL Insurance Beats Traditional College Savings (And Protects Your FAFSA Too)

Yes, IUL insurance can outperform 529 plans for college funding, especially when you factor in FAFSA protection and long-term wealth building. While 529 plans have dominated conventional college planning advice for years, they may actually be sabotaging your family's financial aid eligibility and limiting your strategic options.

The reality is that most parents are following outdated advice that costs them thousands in lost financial aid and missed opportunities for generational wealth building. Here's why IUL insurance deserves serious consideration as your primary college funding vehicle.

The Hidden FAFSA Trap in 529 Plans

When you complete the Free Application for Federal Student Aid (FAFSA), 529 plan assets count as parental assets. This seemingly minor detail can devastate your financial aid eligibility.

Here's the math that matters:

Parental assets reduce aid eligibility by up to 5.64% of their value annually

A $100,000 in a 529 plan could cost your family $5,640 per year in lost financial aid

Over four years, that's potentially $22,560 in additional college costs

IUL cash value, however, is completely invisible to FAFSA calculations. The cash value in your life insurance policy isn't reported as an asset, giving your family a massive advantage in the financial aid process.

Why IUL Insurance Outperforms 529 Plans Long-Term

Front-Loaded Expenses vs. Long-Term Gains

The First 10-15 Years: 529 plans typically show stronger initial growth due to lower upfront costs. Most IUL policies are front-loaded with insurance costs, commissions, and administrative fees that can dampen early performance.

Years 15 and Beyond: This is where IUL insurance shines. Once the initial expense period passes, IUL policies often deliver superior performance through:

Tax-deferred growth with no contribution limits

Participation in market gains with downside protection

Tax-free access to funds through policy loans

Continued life insurance protection

Market Protection That 529s Can't Offer

529 Plans: Your money follows market fluctuations directly. Market crashes can devastate college funds right when you need them most.

IUL Insurance: Most policies include floor protection (typically 0-2% minimum), meaning your cash value never decreases due to market downturns. You participate in market gains while avoiding losses.

The Flexibility Factor

529 Plan Limitations

Funds must be used for qualified education expenses or face penalties

Limited investment options (typically age-based portfolios)

Beneficiary changes restricted to family members

Non-education withdrawals trigger taxes and penalties on earnings

IUL Insurance Advantages

Access cash value for any purpose without penalties

Policy loans are tax-free and don't require credit approval

Can redirect funds if educational plans change

Maintains life insurance protection throughout

Real-World Scenarios Where IUL Wins

Scenario 1: The High-Income Family

The Johnson Family:

Annual income: $150,000

Traditional advice: Max out 529 contributions

Better strategy: IUL insurance maximizes FAFSA aid eligibility while building wealth

Result: By using IUL instead of 529 plans, they potentially qualify for $8,000+ more in annual financial aid while building a tax-free retirement supplement.

Scenario 2: The Uncertain Future

The Martinez Family:

Child considering trade school vs. traditional college

Concerned about education cost inflation

IUL advantage: Funds can pivot to any use without penalties

Result: Complete flexibility to adapt to changing educational landscapes and career paths.

Scenario 3: The Multi-Generational Planner

The Chen Family:

Wants to fund college AND build legacy wealth

Traditional approach: Separate college and life insurance strategies

IUL strategy: Accomplishes both goals in one efficient vehicle

Result: College funding that doesn't disappear after graduation: becomes a wealth transfer tool for grandchildren.

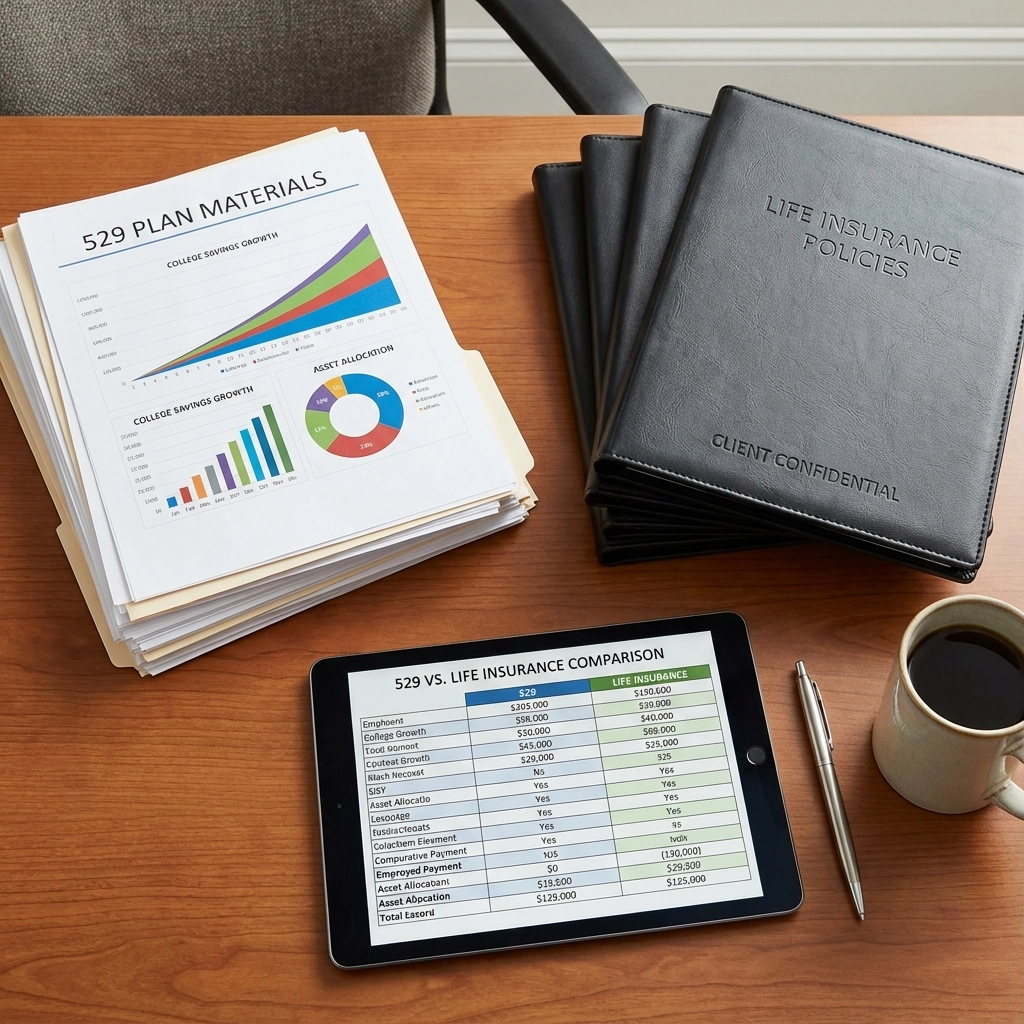

Understanding the Numbers

Contribution Comparisons

Factor | 529 Plan | IUL Insurance |

Annual Contribution Limits | $17,000+ (gift tax limit) | Varies by income/age |

Total Contribution Capacity | $300,000+ per beneficiary | $50,000-$500,000+ lifetime |

FAFSA Impact | Reduces aid eligibility | Zero impact |

Tax Treatment | Tax-free for education | Tax-free loans |

Performance Projections

Assuming $500/month contributions over 18 years:

529 Plan (7% average return):

Total contributions: $108,000

Projected value: $197,000

FAFSA impact: -$11,100 in lost aid over 4 years

IUL Insurance (6% average return after expenses):

Total contributions: $108,000

Projected cash value: $165,000

Death benefit: $250,000+

FAFSA impact: $0

Net advantage: IUL provides life insurance protection plus better financial aid outcomes, potentially offsetting lower cash accumulation.

Implementation Strategy

Step 1: Assess Your Timeline

15+ years until college: IUL becomes increasingly advantageous

10-14 years: Hybrid approach may be optimal

Less than 10 years: 529 plans may still make sense

Step 2: Evaluate Your Risk Tolerance

Conservative investors: IUL's floor protection appeals to risk-averse families

Aggressive investors: May prefer 529 market exposure despite volatility

Step 3: Consider Your Complete Financial Picture

Life insurance needs

Retirement planning goals

Income tax situation

Estate planning objectives

Common Misconceptions Debunked

"IUL Insurance Is Too Expensive"

Reality: While upfront costs are higher, the combination of tax advantages, FAFSA protection, and life insurance benefits often provides superior value over 15+ year periods.

"529 Plans Always Grow Faster"

Reality: Tax-free loans from IUL can effectively provide higher net returns than taxable 529 withdrawals, especially in higher tax brackets.

"Life Insurance Should Be Separate from College Planning"

Reality: Combining strategies creates efficiency and reduces the total cost of achieving multiple financial goals.

The Integration Approach

Rather than viewing this as an either/or decision, many sophisticated families use a hybrid strategy:

Primary Strategy: IUL Insurance (70-80% of college funding)

Maximum FAFSA protection

Life insurance security

Tax-free access flexibility

Secondary Strategy: 529 Plans (20-30% of college funding)

State tax deduction benefits where available

Simple contribution and management

Backup funding source

This approach maximizes the benefits of both vehicles while minimizing their respective limitations.

Professional Guidance Is Essential

Implementing an IUL strategy requires careful policy design and ongoing management. Key considerations include:

Policy structure optimization: Minimizing insurance costs while maximizing cash accumulation

Premium payment strategies: Balancing growth with affordability

Tax compliance: Ensuring modified endowment contract (MEC) limits aren't exceeded

Performance monitoring: Regular reviews to ensure policies remain on track

Working with qualified professionals who understand both college planning and life insurance optimization is crucial for success.

State-Specific Considerations

Remember that FAFSA deadlines vary by state. Texas, Michigan, and California families face a critical January 15th deadline for maximizing state financial aid programs. Starting your IUL strategy early: ideally in your child's sophomore year of high school: provides maximum benefit for both wealth accumulation and financial aid optimization.

For professional guidance on implementing these strategies, consider financial literacy consultation to develop a customized approach for your family's unique situation.

The Bottom Line

While 529 plans remain useful tools for college funding, they're not the universal solution that conventional wisdom suggests. For families prioritizing financial aid eligibility, seeking maximum flexibility, and building long-term wealth, IUL insurance offers compelling advantages that deserve serious consideration.

The key is understanding that college funding isn't just about accumulating money: it's about strategically positioning your assets to minimize costs while maximizing opportunities. In that context, IUL insurance often provides the superior pathway to achieving your family's educational and financial goals.

.jpg)

Comments