Are You Making These 7 Common FAFSA Mistakes? The Ultimate Asset Protection Guide for Smart Parents

- Reuben Lowing

- Dec 18, 2025

- 5 min read

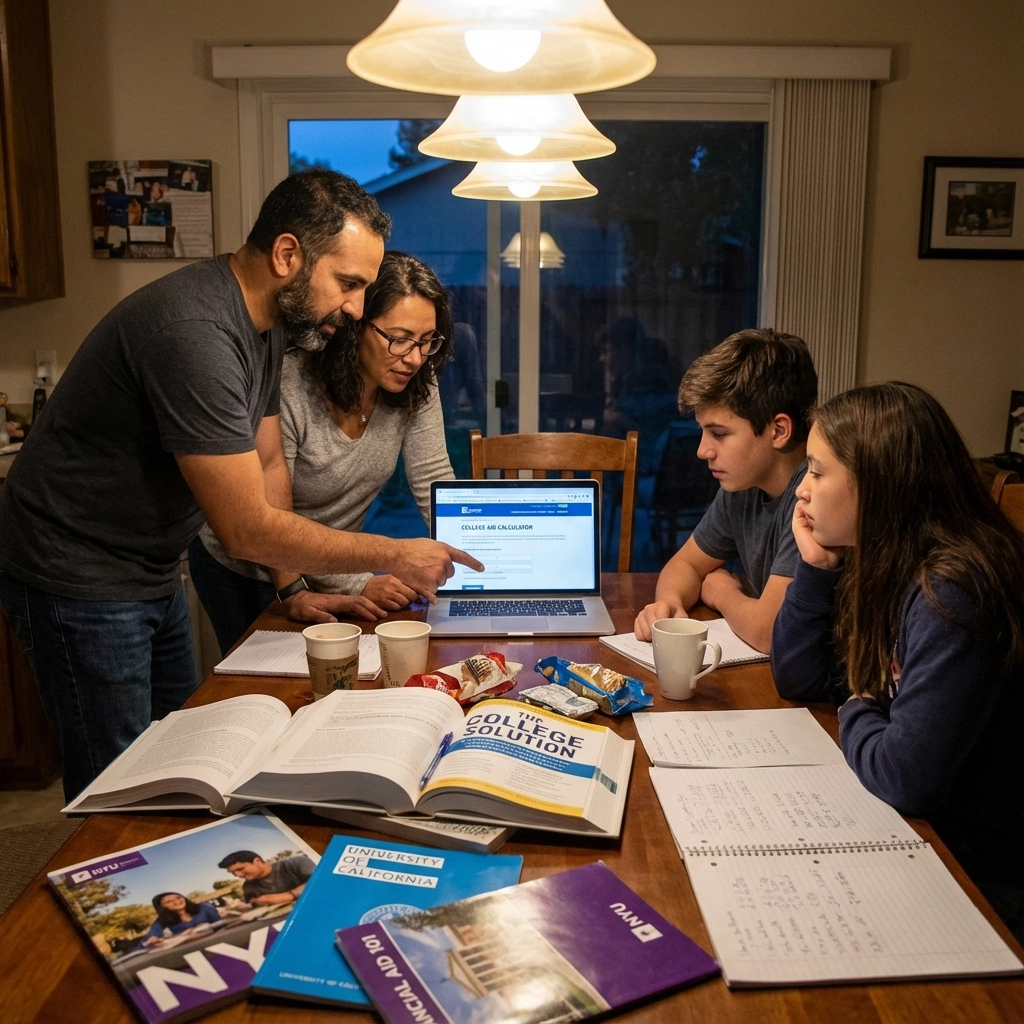

Yes, most parents make critical FAFSA mistakes that cost their families thousands in potential financial aid. The Free Application for Federal Student Aid (FAFSA) uses complex asset assessment formulas that heavily penalize certain types of holdings while completely ignoring others. Understanding these rules and avoiding common errors can dramatically increase your family's aid eligibility.

The financial aid system evaluates parent and student assets differently, creating opportunities for strategic positioning that many families overlook. With college costs continuing to rise and the 2025-2026 FAFSA deadline approaching (January 15th for Texas, Michigan, and California residents), now is the time to understand these critical mistakes and take corrective action.

Mistake #1: Holding Assets in Your Student's Name

The most expensive error parents make involves asset ownership. Student assets are assessed at a flat 20% rate with no protection allowance, while parent assets are assessed at a maximum rate of 5.64%. This means $10,000 in a student's savings account reduces aid eligibility by $2,000, compared to only $564 if held in the parent's name.

The Fix: Transfer reportable assets from student accounts to parent accounts before filing the FAFSA. However, avoid gifting assets to your child as a strategy: this backfires by subjecting them to the higher student assessment rate.

Key Deadline: Complete asset transfers at least one day before filing your FAFSA to ensure proper reporting.

Mistake #2: Maintaining UGMA or UTMA Custodial Accounts

Uniform Gifts to Minors Act (UGMA) and Uniform Transfers to Minors Act (UTMA) accounts are treated as student assets on the FAFSA, triggering the punitive 20% assessment rate. Many parents established these accounts years ago without understanding the financial aid implications.

The Fix: Convert UGMA and UTMA accounts to custodial 529 college savings plans. This changes the assessment from 20% (student asset) to a maximum of 5.64% (parent asset). The conversion process requires:

Liquidating existing investments in the custodial account

Recontributing the cash proceeds to a custodial 529 plan

Maintaining the same beneficiary (your child)

Important Note: 529 contributions must be made in cash, so you'll need to sell any investments first. Consult a tax professional about potential capital gains implications.

Mistake #3: Missing the Simplified Needs Test Exemption

Families with adjusted gross income under $60,000 may qualify for the Simplified Needs Test, which completely exempts all assets from FAFSA calculations. This powerful provision allows families to hold unlimited assets without affecting aid eligibility, yet many don't realize they qualify.

The Fix: Review your income carefully and consider income timing strategies if you're close to the $60,000 threshold. Additional qualifying criteria include:

Filing Form 1040 with specific schedules

Receiving certain federal benefits

Having a family member participate in federal means-tested benefit programs

Strategic Consideration: If your income fluctuates around this threshold, timing certain income items or deductions could help you qualify.

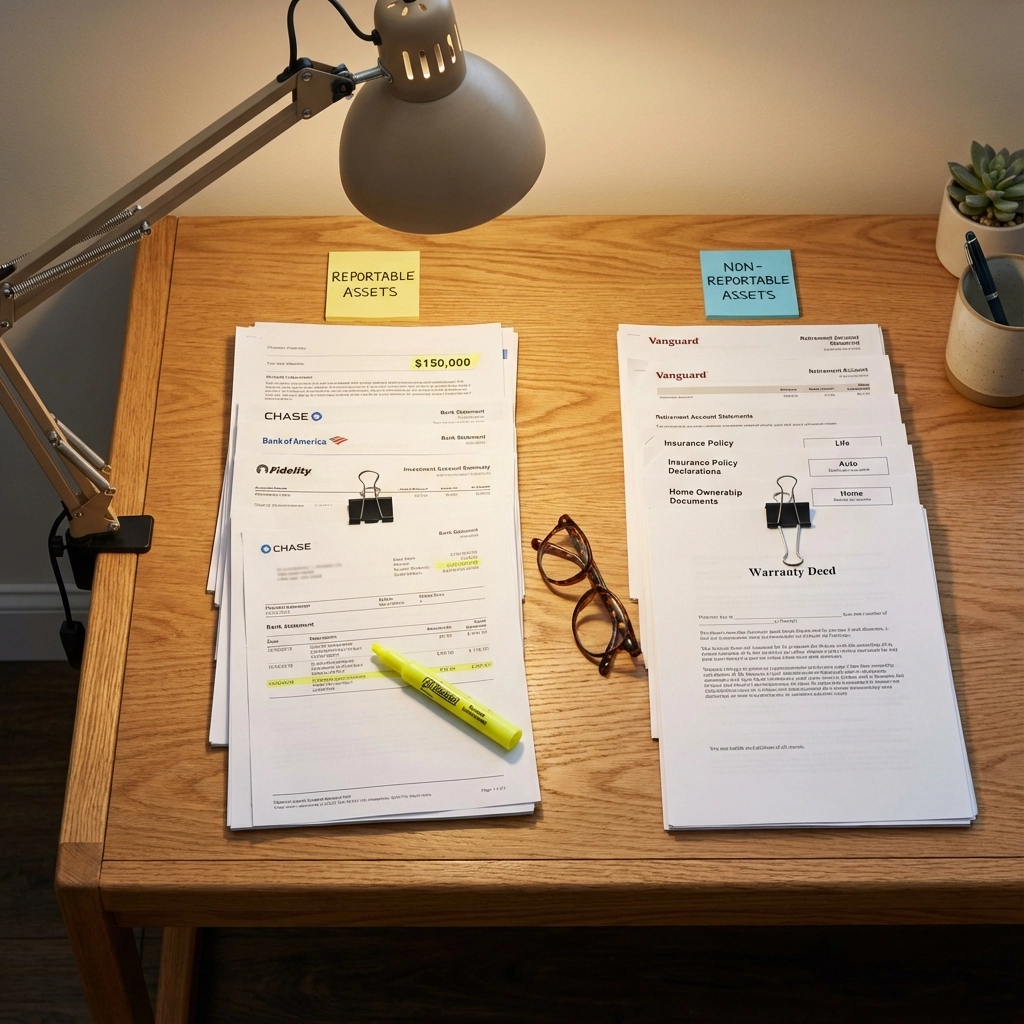

Mistake #4: Misunderstanding Reportable vs. Non-Reportable Assets

Confusion about which assets require reporting leads to both over-reporting (reducing aid unnecessarily) and under-reporting (risking verification issues). The FAFSA requires reporting specific asset categories while exempting others entirely.

Reportable Assets:

Savings and checking account balances

Investment account values (stocks, bonds, mutual funds)

Real estate other than your primary residence

Business or farm equity (if not your primary residence)

Non-Reportable Assets:

Retirement accounts (401k, IRA, pension funds)

Primary residence value

Personal property (cars, furniture, clothing)

Life insurance cash value

Annuity values

The Fix: Ensure you're only reporting required assets while maximizing contributions to non-reportable categories like retirement accounts.

Mistake #5: Failing to Maximize Retirement Contributions

Retirement accounts receive complete protection from FAFSA asset calculations, making them one of the most effective asset protection strategies. Many parents miss opportunities to shelter assets by maximizing contributions to 401(k), 403(b), IRA, and other qualified retirement plans.

The Fix: Before filing the FAFSA, maximize contributions to all available retirement accounts:

401(k)/403(b): $23,500 for 2024 ($31,000 if 50 or older)

Traditional/Roth IRA: $7,000 for 2024 ($8,000 if 50 or older)

SEP-IRA: Up to 25% of compensation (maximum $69,000 for 2024)

Timing Strategy: Make contributions before filing your FAFSA to remove assets from the reportable category immediately.

Mistake #6: Not Using Reportable Assets to Reduce Debt

Holding substantial cash while carrying non-deductible debt represents a missed opportunity for asset protection. Using reportable assets to pay down debt reduces your reportable asset base while improving your overall financial position.

The Fix: Before filing the FAFSA, consider using reportable assets to pay down:

Credit card balances

Auto loans

Non-deductible personal loans

Mortgage principal (if beneficial for your situation)

Strategic Analysis: Calculate the impact of debt reduction versus keeping assets available for college expenses. The optimal approach depends on your specific financial situation and aid eligibility.

Caution: Don't reduce assets if doing so would eliminate important emergency funds or create cash flow problems.

Mistake #7: Implementing Strategies Without Running the Numbers

The most fundamental mistake involves implementing asset protection strategies without first determining whether they'll meaningfully impact your aid eligibility. High-income families may receive no need-based aid regardless of asset positioning, making these strategies unnecessary.

The Fix: Use the Federal Student Aid Estimator at https://studentaid.gov/h/apply-for-aid/fafsa to model different scenarios before making changes. Test various asset levels to understand how repositioning affects your Expected Family Contribution (EFC).

Key Considerations:

Asset Protection Allowance is currently near historical lows

A 48-year-old single parent receives only $2,500 protection for 2025-2026

High-income families may not benefit from asset strategies

Professional Asset Protection Strategies

Beyond these common mistakes, sophisticated families often benefit from professional asset protection strategies that legally optimize FAFSA calculations. Life insurance and annuities represent non-reportable assets that can provide both wealth protection and aid optimization benefits when structured properly.

Working with financial professionals helps ensure these strategies align with your family's overall financial plan while maintaining compliance with federal regulations. Professional guidance becomes particularly valuable when dealing with:

Complex family business ownership

Investment property holdings

Trust structures

Retirement plan distributions

State-specific aid programs

Taking Action Before the Deadline

With critical FAFSA deadlines approaching, now is the time to review your asset positioning and implement necessary corrections. Start by calculating your current Expected Family Contribution using the federal estimator, then model the impact of correcting these common mistakes.

Remember that asset values on the FAFSA reflect balances as of the date you file, creating opportunities for strategic timing. However, any changes should align with your overall financial plan and cash flow needs.

Next Steps:

Run current numbers through the federal aid estimator

Identify which mistakes apply to your situation

Calculate potential aid improvements from corrections

Implement changes before filing your FAFSA

Consider professional consultation for complex situations

Disclaimer: This information is for educational purposes only and should not be considered personalized financial advice. Consult with qualified financial and tax professionals before implementing any strategies. FAFSA rules and aid calculations can change, so verify current requirements before filing.

The difference between strategic FAFSA preparation and simply filling out forms can mean thousands of dollars in additional aid eligibility. By avoiding these seven common mistakes and positioning your assets strategically, you're taking an important step toward making college more affordable for your family.

.jpg)

Comments